Abu Dhabi’s real estate market has now become increasingly accessible for expatriates and foreign investors, and is known for offering attractive opportunities for anyone looking forward to investing in a property. Non-residents do account for 30% to 40% of the overall mortgage bookings done in the UAE.

Given the transparent regulatory framework and the growing demand for commercial and residential spaces, securing mortgages for non-residents in Abu Dhabi is now more feasible than ever. However, understanding the financial requirements, eligibility criteria, and application process is critical before starting your investment journey.

Keep reading as we are about to guide you through the entire property purchase process for non-residents in Abu Dhabi, with valid tips that will help you secure a property with the help of real estate experts.

Understanding Mortgages for Non-Residents in Abu Dhabi

A non-resident mortgage is known to be a home loan provided to individuals who do not reside in the UAE but have a wish to purchase property within the country.

- Unlike the resident mortgages that usually come with more feasible terms, the non-resident mortgages or foreigner mortgage in Abu Dhabi involve stricter conditions, including lower LTV (loan-to-value) ratios and higher down payment requirements.

- Foreigners do have permits to buy property in designated freehold zones in Abu Dhabi, such as Yas Island, Al Reem Island, and Saadiyat Island.

- Many UAE-based banking institutions offer customized mortgage solutions for residents, further making it essential to compare such options to find the best fit for your investment goals and financial situation.

Our in-house team of expert real estate agents will rightly guide you through such options and help identify banks that can offer the most competitive terms for potential non-resident buyers.

Key Financial Features

1. Loan-to-Value (LTV) Ratio

Non-resident Loan-to-value (LTV) ratios basically range from 50% to 60%, and you may need to provide a down payment of about 40% to 50% of the overall property’s value. Some banking institutions might offer up to 70% LTV in certain cases, but this is less common.

2. Down Payment

The down payment for non-residents in Abu Dhabi does vary, and they are mostly:

- Properties coming under AED 5 million: Typically require 40% to 50% of the down payment.

- Properties that are over AED 5 million: Most often require 50% down payment.

3. Maximum Loan Limit

The maximum loan amount available for non-residents can go up to AED 6 million, based on the applicant’s financial profile and the lender.

4. Repayment Terms

Foreigner mortgage in Abu Dhabi tenures for the non-residents typically range from 5 to 25 years at the most. Lenders most often require not more than 50% to 60% of your monthly income be allocated towards the respective debt repayment.

5. Interest Rates

The interest rates for non-resident mortgages are usually higher when compared with resident mortgages, and are often linked to the EIBOR (Emirates Interbank Offered Rate) or the MBR (Monthly Base Rate). Rates might be variable, and they are usually influenced by local monetary policies and global economic trends.

Our real estate agents will help you better evaluate all these financial factors, search for, and find properties that can align with your mortgage eligibility and budget.

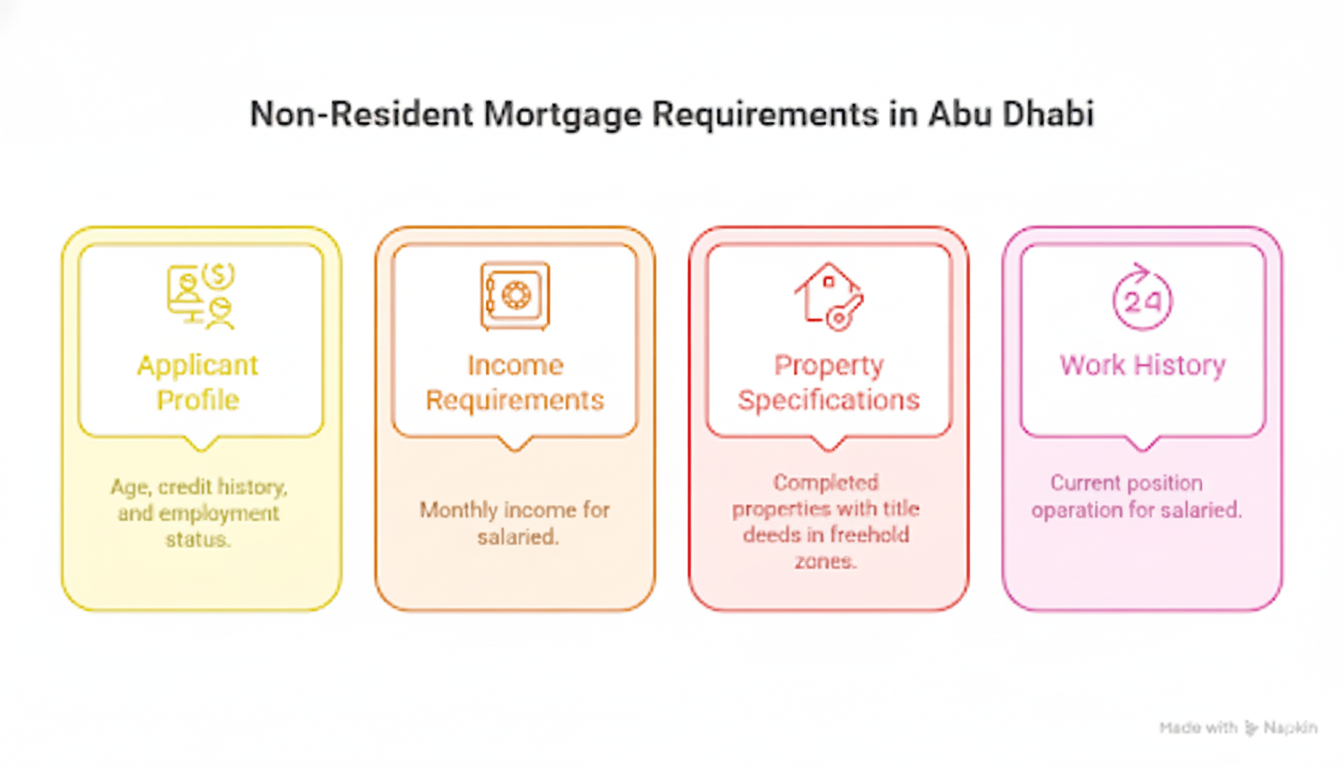

Eligibility and Requirements

Understanding the eligibility criteria and the respective non-resident mortgage Abu Dhabi requirements must be given importance. Learning such factors will help in ensuring that your application meets the respective bank’s standards, increases your chances of approval, and reduces the risk of delays.

- Starting from age, employment history, income thresholds, and property type, each and every element plays a significant role in rightly determining whether you can qualify for a home loan for foreigners.

By reviewing all these requirements well in advance, as a non-resident buyer, you can prepare the necessary documentation, better streamline the mortgage process, and make informed decisions for a faster and smoother property purchase.

Applicant Profile

- Age: 25 to 65 years old.

- Credit History: A strong credit report is highly essential.

- Employment Status: Only salaried applicants are eligible.

Income

- Salaried Employees: Having a monthly income of AED 15,000 is a must.

Property Type

- Every eligible property gets completed with title deeds, while the under-construction or off-plan properties are typically not financed.

- Properties should be located within the respective freehold zones in Abu Dhabi.

Work History

- Salaried Employees: Minimum completion of 6 months in the current job.

Navigating all these non-resident mortgage Abu Dhabi requirements can be complex without professional help.

This is where our real estate agents excel, and they will help simplify the entire process, further ensuring that you meet all respective eligibility criteria even before applying for a mortgage.

Required Documentation

Personal Documents

- A valid passport

- The latest three months of bank statements are to be submitted as proof of funds.

Salaried Employees

- Pay slips, salary certificate, liability, or reference letter

Property Documents

- Offer letter from the property seller, title deed, sale or purchase agreement, and a valid proof of down payment for non-residents in Abu Dhabi.

Our in-house team of experienced real estate agents will assist in rightly organizing and timely reviewing your documentation to prevent possible delays in terms of acquiring approval for a foreigner mortgage in Abu Dhabi.

Application Process & Timeline

Securing mortgages for non-residents in Abu Dhabi does involve a clear step-by-step process that is designed to ensure that both the lender and the buyer are confident in the transaction. By understanding these steps, you are about to simplify the journey and even efficiently navigate as per the system.

Whether you are applying for a customized non-resident mortgage or home loan for foreigners, knowing what all you can expect will certainly save you time and even prevent facing possible delays.

Process Steps

- Submit Interest or Mortgage Calculator

You must start by expressing your interest in a particular property and use online mortgage calculators to calculate the mortgage value as offered by the real estate firms or banking institutions. This further helps in estimating your eligibility, potential loan amounts, and the monthly installments you can prefer to repay.

- Consultation and Approval in Principle (AIP)

Engage with the lender to discuss your financial profile. Banks do provide an AIP (Approval in Principle), further indicating the loan amount you can qualify for, given your credit history, income, and the chosen property.

- Valuation of Property (after MOU)

Once the MOU (Memorandum of Understanding) with the seller has been officially signed, the property gets professionally valued to confirm its actual market worth.

- Submitting Required Documentation

Provide all employment, personal, and property-related documents to the banking institution for verification purposes.

- Sign Offer Letter or Mortgage Approval

Review and then sign the mortgage offer, further confirming the listed set of terms and conditions.

- Registration and Disbursal at Land Department

Finalize the entire process by registering the property with the Land Department and receiving the loan disbursal.

Following all these steps ensures that your non-resident mortgage in Abu Dhabi application remains smooth, error-free, and reduces the risk of facing unexpected delays.

Estimated Duration

- Pre-approval: Takes less than 60 minutes

- Salaried Processing: 7 to 10 days

- Total Arrangement: Takes up to 14 working days

With our real estate agents’ help available by your side, you can significantly reduce your overall time spent in terms of navigating these steps and ensure a hassle-free process.

Costs and Fees

While you apply for a mortgage for non-residents in Abu Dhabi, it is essential to understand the budget for various fees that go beyond the down payment. The key costs you must get to know include:

- Mortgage Registration Fee: This fee is approximately 0.1% of the overall loan amount, and can be paid upfront as per the UAE regulations.

- Property Transfer Fee: This fee is typically 2% of the overall property’s value, and is shared between the seller and buyer unless otherwise negotiated.

- Valuation Fee: This fee ranges from AED 2,500 to AED 3,500, based on the lender.

- Bank Processing Fee: This fee is usually 0.5% to 1% of the approved loan amount, and some banks might waive this for salary transfer customers.

- Agency Commission: This fee typically is 2% of the property price, including VAT.

All the above-mentioned fees are non-negotiable and should be paid upfront, even when not included in the mortgage loan.

Benefits of UAE Investment

- High Rental Yields – Properties in Abu Dhabi are known for providing competitive returns when compared to properties located in other parts of the world.

- Economic Stability – The overall economic condition in the UAE has remained diversified and robust in recent years.

- Tax Advantages – There are no property taxes included for investors.

- Strategic Location – Abu Dhabi, as a business hub, rightly attracts international tenants.

Partnering with SixS Real Estate experts ensures that you can identify prime locations and properties that tend to maximize all these benefits.

Conclusion

Securing a mortgage as a non-resident in Abu Dhabi is achievable with proper preparation and guidance. By aligning your financial profile with lender expectations and ensuring documentation is complete, you can invest confidently in Abu Dhabi’s thriving property market.

SixS Real Estate is your trusted partner, helping you find the right property, connect with suitable lenders, and navigate the foreigner mortgage in Abu Dhabi process from start to finish.

Contact our experts today to explore your investment opportunities in Abu Dhabi.

Frequently Asked Questions

- Can I get a mortgage in Abu Dhabi even if I’m not a resident?

Yes, non-residents can obtain mortgages in Abu Dhabi, provided they meet the respective eligibility criteria as set by the lenders.

- What is the minimum down payment required for non-residents?

Typically, a down payment for non-residents in Abu Dhabi remains anywhere between 40% to 50%, based on the property’s value and the lender’s policies.

- Are there any age restrictions for mortgage applicants?

Applicants should be between 25 and 65 years old at the time of application.

- How long does the mortgage approval process take?

The entire mortgage approval process can take up to 14 working days, and it highly depends upon the applicant’s circumstances.

- Can I finance off-plan properties as a non-resident?

Generally, non-residents are not eligible for financing off-plan or under-construction properties.