Common Real Estate Investment Mistakes to Avoid in Abu Dhabi

Are you someone who is looking to fetch a big-time fortune? Then the buzzword for you is real estate property investment. Although it might seem promising at first glance, it is imperative to take the right steps to truly understand the game. The reason for doing so is that there are certain grave pitfalls you need to avoid if you want to invest money properly and make lucrative profits. Yes, large profits indeed that ensure robust returns in the long run. The point is to avoid common real estate investment mistakes, regardless of the circumstances. The good news is that now you are at the right spot. This article is going to give you a clear insight into how you can become successful when it comes to Abu Dhabi real estate investment. So, continue reading ahead.

Table of contents

Common Real Estate Investment Mistakes

Research and planning mistakes

Both research and planning mistakes can make your real estate investment plans in Abu Dhabi go wrong and should be avoided. Besides that, waiting for the right deal is also highly advisable since you know you are investing wisely.

- Inadequate Planning and Strategy

When you closely look at it, the whole procedure of property investment in Abu Dhabi is relatively straightforward. At the same time, overlooking the crucial financial and legal procedural details can prove to be a big misfire. So, it is important to have proper planning and strategy for staying clear of any unwanted legal or financial complications.

- Lack of Patience and Long-Term Perspective

You should remember that it is critical not to be hasty and must have a long-term perspective to get rid of any real estate mistakes in Abu Dhabi. So, patience is key, and you should be able to have an eagle’s eye when it comes to searching for good prospective real estate deals in the region.

Financial Mistakes

There are some critical financial mistakes most investors are bound to make if they lack proper awareness when it comes to property purchase in the UAE. They are as follows.

- Insufficient Capital and Poor Financial Management

Many people these days who are eager towards investing in Abu Dhabi real estate often overlook their actual financial capacity. Either they might not have adequate funds for striking a lucrative real estate property deal, or they might tend to overspend rather than the actual price. This is why both insufficient capital and a lack of proper financial management can lead them to face debts rather than making large monetary gains.

So, you need to have a proper idea regarding your cash at hand, knowledge about the current Abu Dhabi property market, and most importantly, a sound financial awareness regarding the complete expenses that you can incur.

- Underestimating Hidden Costs

Now while when it comes to making a property investment in Abu Dhabi, it is not just about dealing with the upfront prices for apartments, villas, or other building infrastructures. It is also very important to have a good understanding of the maintenance fees, furnishing costs, and property taxes that come along. Or else, it can lead to unwanted financial burdens in the future.

Related Blogs: The Hidden Costs of Buying Property in Abu Dhabi

- Overleveraging and Debt Mismanagement

Proper Abu Dhabi real estate investment is obviously a good step that you can take to secure a high financial status. However, be it for real estate property investment or creating a new home base, a good knowledge of the overall financial procedures is essential. You should have a clear idea of your actual financial capacity. Getting pre-approvals from reputed banks or any reliable mortgage brokers will be very helpful. By doing so, you will have an exact idea of your spending range and repayment capabilities. This is crucial for avoiding overleveraging or any debt mismanagement in the future.

Due Diligence & Compliance Mistakes

Adhering to the regulatory principles is mandatory when you want to make safe and lucrative profits in the Abu Dhabi real estate market. By doing so, you are making your property deals with due diligence and devoid of compliance mistakes.

- Failure to Perform Due Diligence

You need to perform a proper check or audit that gives you better clarity related to the seller’s legal ownership, permits, approvals, and also make sure that the property is free of any pending disputes. These aspects are very crucial while investing in Abu Dhabi real estate. It will help you stay clear of unwanted financial hazards/offences and make you confident that you are not committing any property-related compliance mistakes.

- Legal and Regulatory Compliance Issues

It is imperative to have a thorough understanding of the compliance regulations and legalities of the UAE region when you want to make a property investment in Abu Dhabi. This will help you to avoid unnecessary legal issues and financial setbacks. So always adhere to the specific compliance policies before making any investment.

- Ignoring Freehold Zone Regulations

As per regional laws, foreign investors can only purchase real estate properties in the UAE that are situated in designated freehold regions. That is why, while investing in Abu Dhabi real estate, you need to abide by the freehold zone regulations and not look for properties outside these specific zones.

Professional Support & Management Mistakes

Always seek the guidance and support of professionals who are well-versed in real estate property management. This way, you can rest assured that you are purchasing the right property without going through trial-and-error methods that can create unwanted financial loss.

- Lack of Networking and Professional Guidance

It is highly recommended to touch base with a list of trusted professionals to make the most of the gains through Abu Dhabi real estate investment. With proper social networking and hiring professional support, you can rest assured that your investment process is streamlined. Most importantly, without any management mistakes.

- Choosing the Wrong Platform or Agent

Choosing an unverified UAE real estate website or associating with unprofessional real estate agents can be detrimental to your dreams for property investment in Abu Dhabi. You need to look for trusted platforms and agents who can provide all the required support for making a profitable investment. By doing so, your investment plans will be accomplished in a foolproof manner.

Inadequate Property Management

Active property management is surely a strategic necessity, especially in a thriving real estate hub like Abu Dhabi. Professional property management firms are the real bridge between potential investors and property owners. They provide you with all the adequate support you need throughout your purchase process. Besides that, you will also get the actual information regarding the prices/rent charges, maintenance features, compliance, and legal procedures. So, you need to avoid firms with inadequate property management and only go for professional ones when you are investing in Abu Dhabi real estate.

Common Investment Mistakes for Expats

Given below are some of the major investment mistakes that expats should be well aware of.

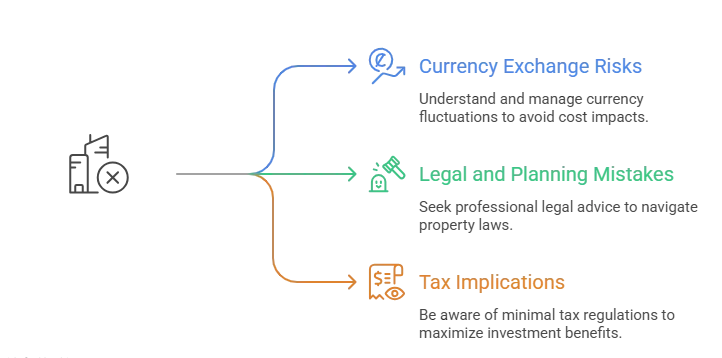

Ignoring Currency Exchange Risks

When you plan to make a property investment in Abu Dhabi, it is crucial to have a sound knowledge of the current currency exchange rates. This is because the occasional fluctuations of exchange rates have a direct impact on the cost of your purchase when buying a property in AED.

Legal and Planning Mistakes

When you are looking for a property for sale in abu dhabhi, it is very important to avoid any legal and planning mistakes. You can do it by seeking the professional support of a native lawyer who is well-versed in Abu Dhabi property law. He or she will be able to help you steer clear of any legal complexities and make your investment plans much smoother.

Not Understanding Tax Implications

Abu Dhabi property market proves to be very lucrative for both property owners and potential investors alike. However, investors must be well-versed regarding the tax implications imposed by the government. Unlike other leading global real estate markets, there is no annual property tax imposed. This fact makes Abu Dhabi a sought-after destination for expatriates and large investors. At the same time, 5% VAT (Value Added Tax) is applicable for commercial property sales such as retail spaces, warehouses, and offices. The same also applies to property management services, which include brokerage and legal fees.

How to Avoid Real Estate Investment Mistakes

Real estate investment mistakes can be easily avoided. All you need to do is focus on the points mentioned below.

Create a Clear Investment Strategy

Most investors rush their decision regarding property investment in Abu Dhabi, which should be avoided at all costs. They need to have a clear investment strategy and must have a proper idea about how their requirements, as well as the property market, can change in the years to come.

Understand Property Types

It is very important to have an in-depth idea about the various property types when you are investing in Abu Dhabi real estate. It is because you need to always go for a wise investment that best suits your requirements and budget. The different types of popular real estate properties in the region are

- Luxury Villas

- Townhouses

- Apartments Located at High-Demand Locations

- Commercial Properties

- Off-Plan Properties

- Waterfront Properties

Apply Sound Financial Management

This plush city provides you with robust rental returns, smart investment options, a high-standard lifestyle, and a secure future. You can achieve all of these with smart planning and a sound financial management strategy. Make sure you are seeking the management expertise of eminent real estate agents in the UAE real estate market. They will surely make your investment plans highly fruitful.

Perform In-Depth Due Diligence

One of the most critical mistakes that many make is rushing into Abu Dhabi real estate investment without doing a thorough inspection of all important documents. Neither do they care to know more regarding the physical condition of the property or the legalities that come with it. You don’t have to worry about due diligence when you perform a proper inspection of all documents, such as title deeds/ legal approvals, and ensure that the property is ideal for investment.

Work With Professional Real Estate Agents for Expert Support

One of the best ways to avoid all the common mistakes is to seek the guidance and proceed with the professional support of trusted real estate agents. By doing so, you can rest assured that your investment is safe and will fetch you a high ROI in the long run.

Conclusion

There is no doubt that you can make a good fortune in Abu Dhabi, the ever-thriving city in the entire UAE region. However, it is very important to stay clear of possible pitfalls that you may confront while dealing in the real estate market. The best thing to do is to associate with a team of experts in this domain and make your investments secure and highly profitable. Contact SIX S REAL ESTATE now, the most reputed property management firm in Abu Dhabi. Get ready to live your dream life with the support of the finest real estate partners that you can always trust.

Frequently Asked Questions

- How vital is market research before going for investment in Abu Dhabi real estate?

Only by doing proper market research will investors get a clear idea about where to put their money promptly and enjoy the high returns they can earn from it.

- How will investors be able to stay well-informed regarding Abu Dhabi real estate regulations?

The finest way is to stay in contact with professional firms that are in frequent engagement with the legal experts who provide the latest updates from official government bodies.

- Is diversification necessary for real estate investment?

Putting money in various profitable properties at different locations will help to mitigate the risk that may occur with minimal returns yielded from a single one.

- Can foreign investors buy and own luxurious properties in Abu Dhabi?

Yes, they can in specific freehold zones approved by the government.

- Is real estate investment in Abu Dhabi now promising and fetching high profits for long years

Yes, the real estate market is flourishing like never before, mainly due to the government’s investor-friendly regulations and assured high returns.